Conclusion

In the long term (as it's why interest us), the level of production is definied by the quantity of inputs (Labor and Capital). The labor market is a big row of the production, and the equilibrium of the capital. Theses creates outputs, the goods and market service. We are under Say's assumptions, so we can resume the economic equilibrium with theses two markets. Everything is determined by the global supply, and so demand with always follow.

Walras' law: if we consider one market in the economy and every other market is in equilibrium, then this last one needs to be at the equilibrium too.

We saw 3 markets : labor market, money market, goods & services market and the financial (assets) market. That's why we didn't take into account the money market that much, as if the 3 first are equilibried the fourth one will be.

This will be the major difference with the next chapter, as Keynes gives more importance to money.

Labor market

Nothing really change on short term. We only take into account production. We just understood that the demand of labor is a raising function of the level of production.

On capital market, the capital stock can change on the long run. We specifically needs to understand how do theses changes react on prices on the long term. But as prices get higher, investment will follows. As the prices increase, the real interest rate

Walras' law

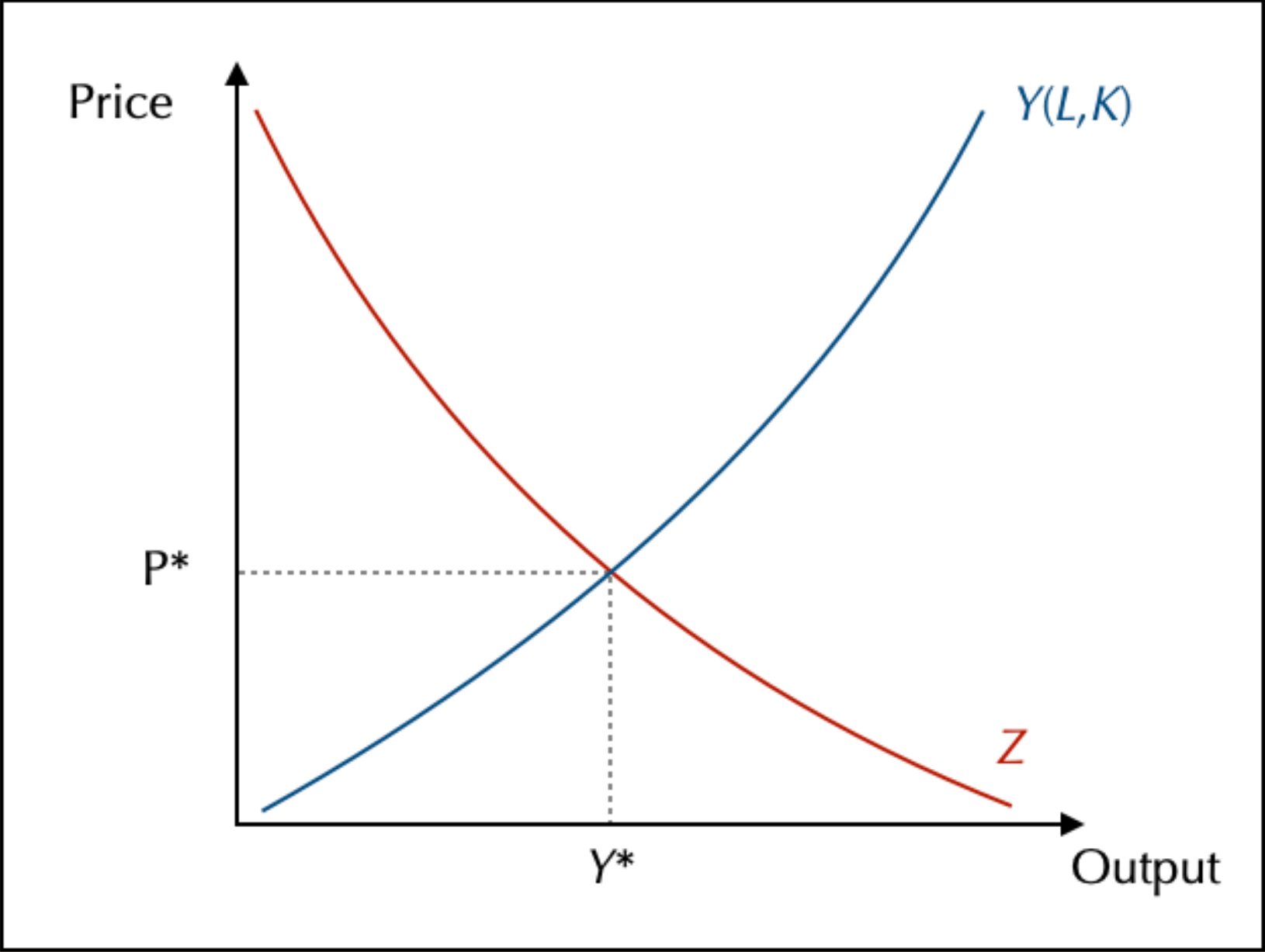

As we can ignore the money market, global equilibrium can be displayed as follow  Y is the global aggregated supply on long run, and Z is the global aggregated O (on long run)

Y is the global aggregated supply on long run, and Z is the global aggregated O (on long run)